1040a 2024 Schedule A

1040a 2024 Schedule A – There are other tax changes happening next year that could put more money in your paycheck. If you collect Social Security, you’ll receive a 3.2% cost-of-living-adjustment in 2024. And since the first . Although the date for filing your tax return for 2024 is a long way off, smart taxpayers will start thinking about that return far in advance. Proper tax planning takes time, so it’s actually wise to .

1040a 2024 Schedule A

Source : www.morton.edu

IRS announces new income tax brackets, higher standard deduction

Source : centraloregondaily.com

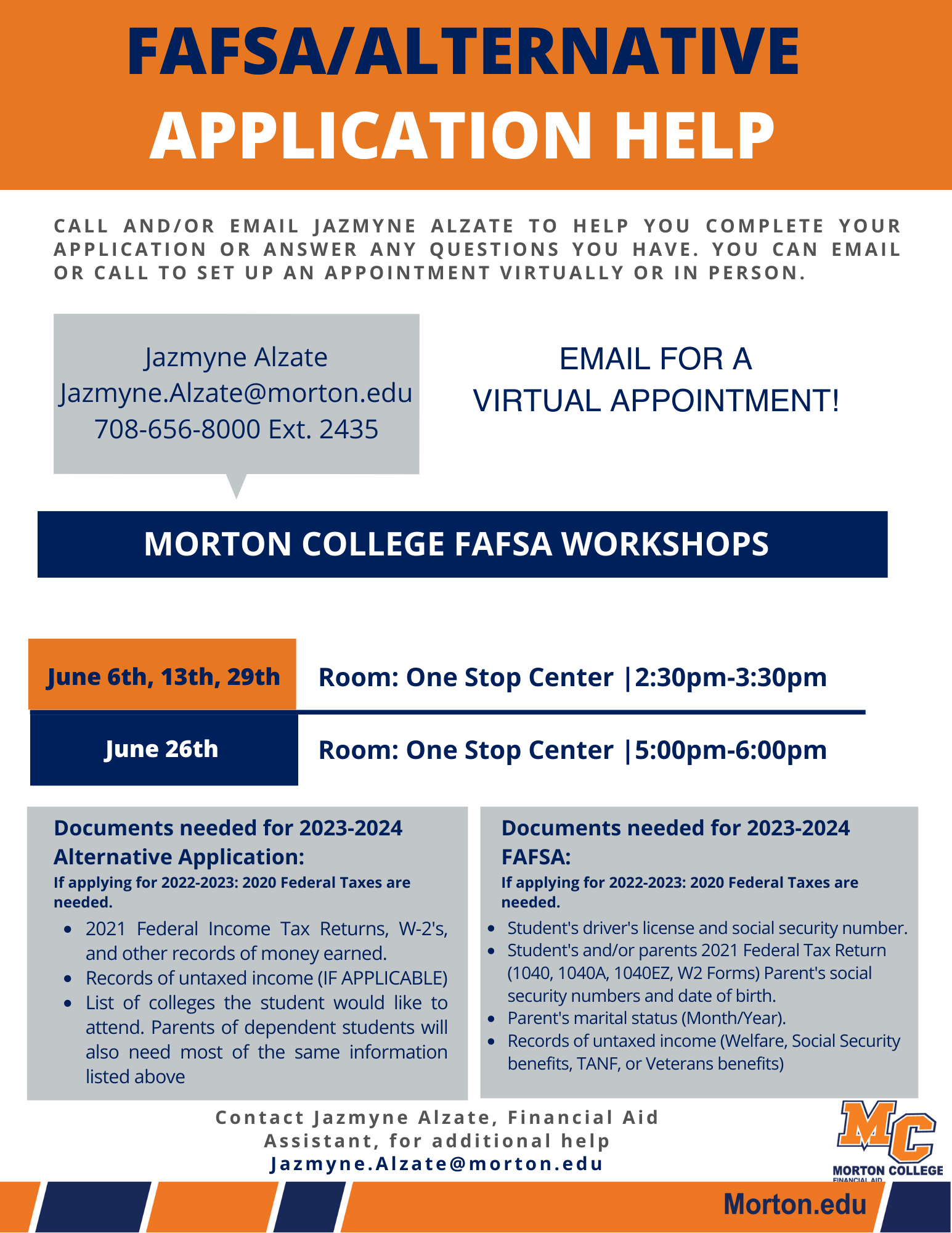

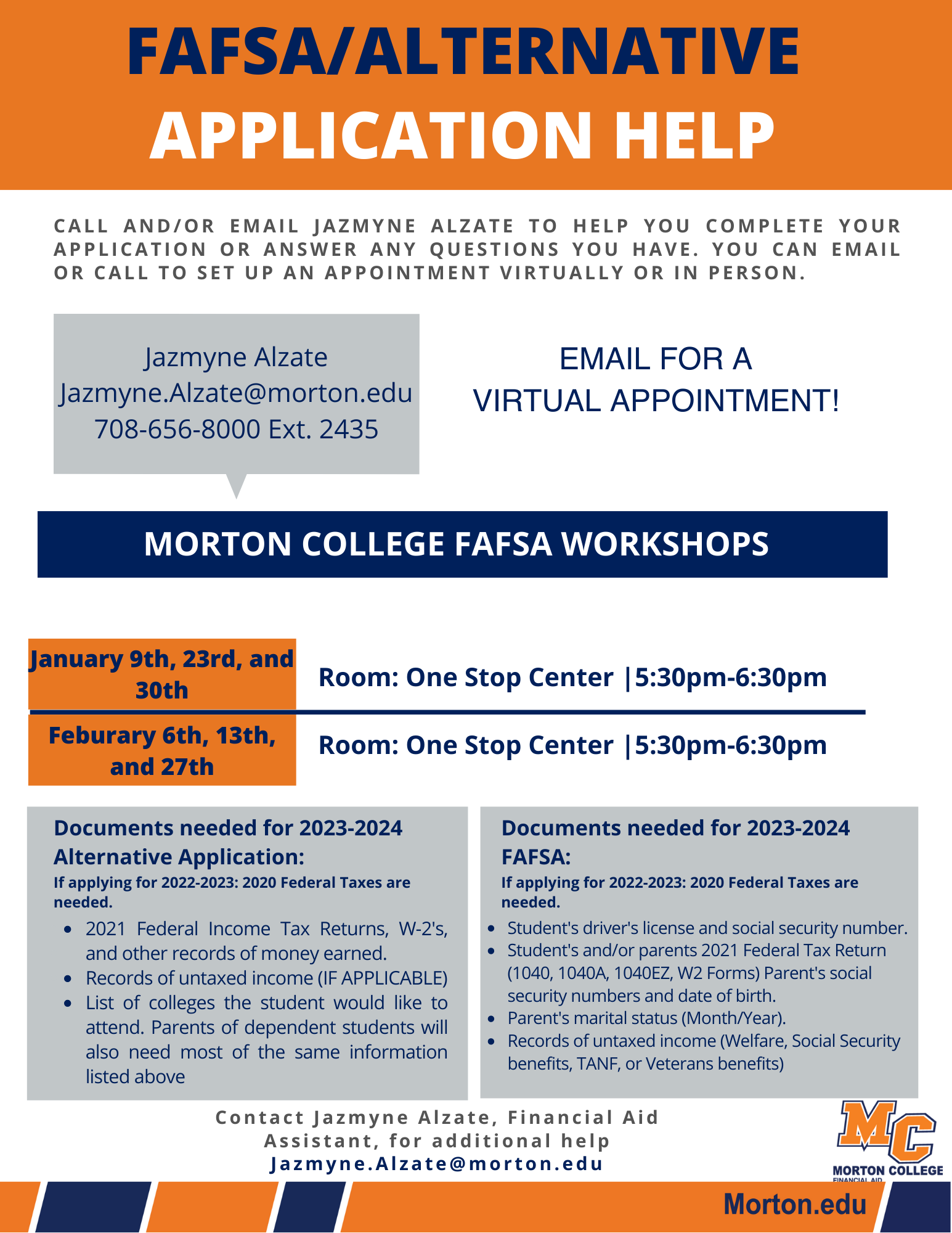

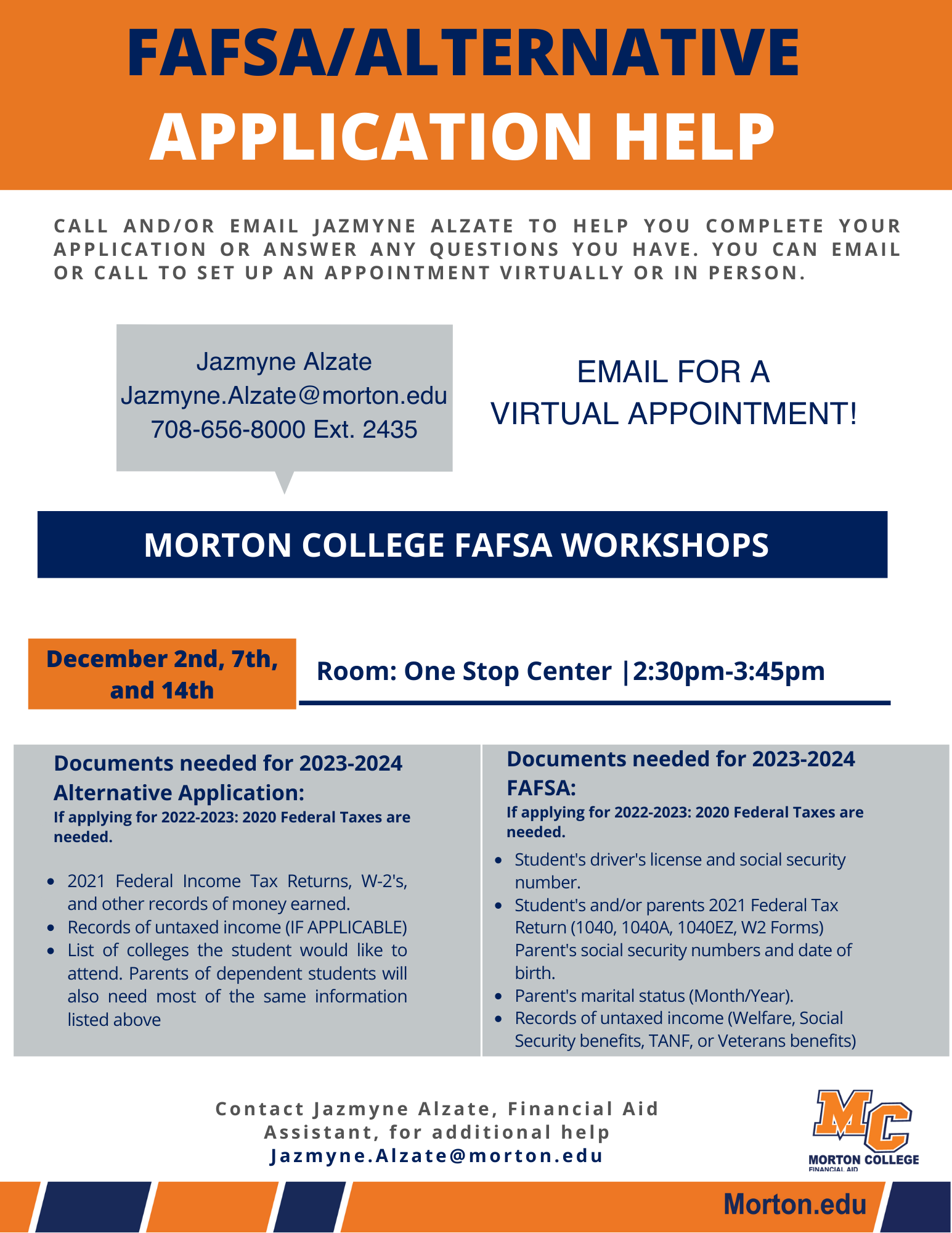

FAFSA/Alternative Application Help – Morton College

Source : www.morton.edu

The Virginia Optometric Association

Source : www.facebook.com

FAFSA/Alternative Application Workshop – Morton College

Source : www.morton.edu

IRS sets new tax brackets for 2024

Source : www.fox26houston.com

Connecticut Department of Revenue Services | Hartford CT

Source : www.facebook.com

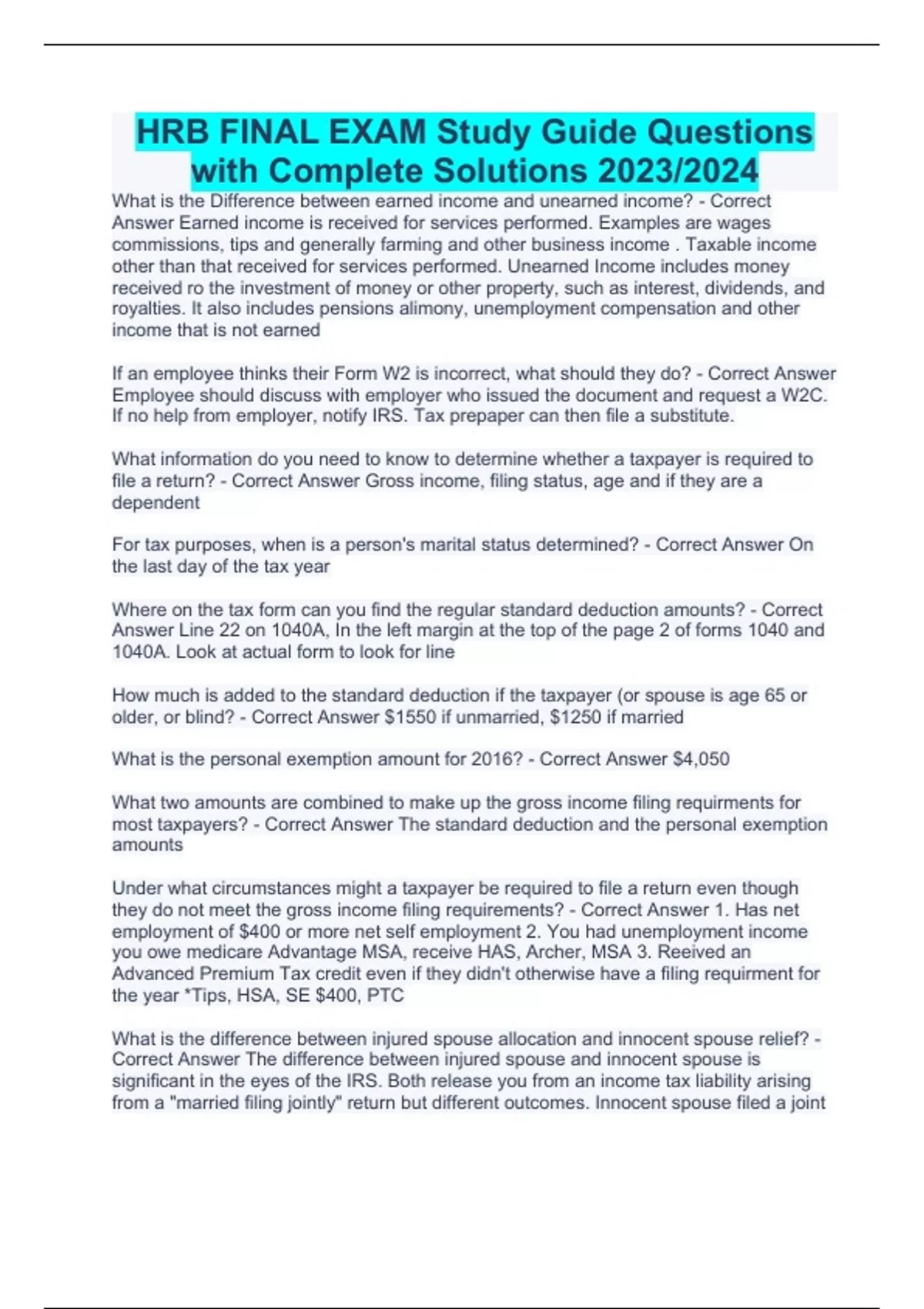

HRB complete Package Deal 2023/2024 Stuvia US

Source : www.stuvia.com

Molen Tax | Houston TX

Source : www.facebook.com

Amazon.com: Oni Tools Hino Rear Crankshaft Oil Seal Installer for

Source : www.amazon.com

1040a 2024 Schedule A FAFSA/Alternative Application Help – Morton College: Don’t miss out during the 2024 tax season. Register for a NerdWallet account flows through to you and gets reported on your individual tax return via Schedule E. By March 15 (or three months after . The IRA contribution limits increase to $7,000 in 2024, or $8,000 for those 50 and older. Next year’s limits are $500 higher than the 2023 IRA limits. .